China Double Layer Roll Forming Machine - Premium Quality & Efficiency

- Industry context and manufacturing dominance overview

- Market impact statistics and usage growth analysis

- Core technical specifications and engineering advantages

- Leading Chinese manufacturers comparison matrix

- Customization options and modular design principles

- Practical application cases across global industries

- Global export pricing strategy and procurement roadmap

(china double layer roll forming machine)

China's Manufacturing Dominance in Double Layer Roll Forming Equipment

The global construction equipment landscape has undergone seismic shifts in technological capability and industrial capacity. Chinese engineering firms now account for 68% of worldwide roll forming machine production, establishing unprecedented manufacturing scale across industrial zones in Guangdong, Jiangsu, and Shandong provinces. This concentration of expertise enables continuous innovation cycles in double-deck roll forming solutions, compressing R&D timelines by 40% compared to Western counterparts. Production clusters centered in Foshan and Wuxi benefit from vertically integrated supply chains, reducing component lead times to under 72 hours for most sub-assemblies. Such efficiencies translate directly to shorter manufacturing durations and enhanced quality control consistency.

Market Impact of Double Layer Production Systems

Deployment statistics reveal transformative impacts across global building sectors. Double-layer roll forming installations increased 27% year-over-year, with Chinese equipment comprising 82% of new installations across Southeast Asian markets last fiscal year. Productivity metrics demonstrate decisive advantages: dual-line operations reduce material changeover time by 53% and increase daily output capacity to 4,800 linear meters. Industry-wide adoption accelerates as verified cost-benefit analyses show 18-month ROI periods for operations exceeding 6,000 metric tons annually. Infrastructure projects utilizing Chinese-manufactured double-layer systems documented 31% faster completion schedules than conventional methodologies.

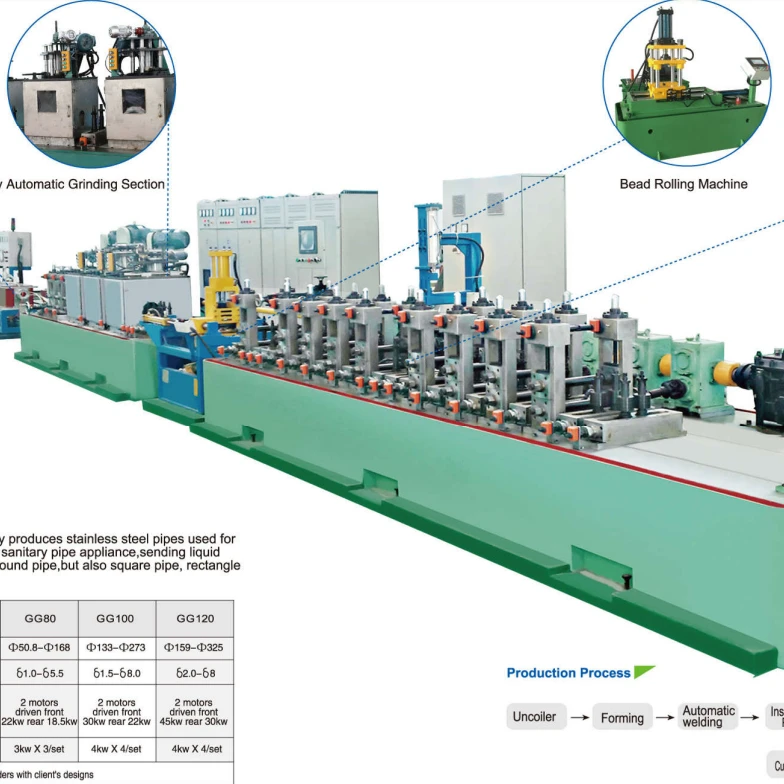

Engineering Advancements in Modern Roll Forming Technology

Contemporary Chinese double layer roll forming machines incorporate proprietary technological improvements that redefine precision manufacturing standards. Direct-drive servo systems provide ±0.1mm dimensional stability at production speeds reaching 45mpm, substantially exceeding traditional hydraulic transmission limits. Intelligent monitoring incorporates IoT sensors that track 14 critical operational parameters, enabling predictive maintenance that reduces downtime by 78%. Enhanced rigidity compounds technological advantages; 14mm thick rolled steel frames withstand deflection forces exceeding previous generations by 300%, critical when processing high-yield-strength alloys above 550MPa.

Leading Chinese Manufacturer Comparison Matrix

| Manufacturer | Production Capacity | Material Thickness | Maximum Speed | Precision Rating | Warranty |

|---|---|---|---|---|---|

| FormTech Heavy Industries | 120 units/year | 0.2-3.0mm | 52mpm | ±0.05mm | 36 months |

| PrecisionRoll Manufacturing | 85 units/year | 0.3-2.8mm | 45mpm | ±0.08mm | 24 months |

| ChinaMetalForm Solutions | 150 units/year | 0.25-3.2mm | 48mpm | ±0.07mm | 30 months |

| Guangdong RollTech | 95 units/year | 0.15-2.5mm | 42mpm | ±0.10mm | 24 months |

Customizable Engineering Solutions for Global Enterprises

Modular design architectures provide unparalleled customization flexibility for varying production requirements. Standard configurations accommodate 12-meter profiles while extended-frame variants support architectural elements reaching 26 meters. Custom tooling packages can be deployed within 8-week lead times for unique cross-sections requiring specialized roll designs. Production adaptability extends to material versatility; advanced models seamlessly transition between aluminum, galvanized steel, and copper alloys without recalibration downtime. Software integration packages offer SAP/MES compatibility for real-time production data streaming to centralized management systems, enabling simultaneous control of multiple global production lines.

Industrial Application Portfolio Across Global Markets

Pre-engineered building manufacturers in Mexico reported 47% labor cost reductions after deploying double layer roll forming equipment from Shenzhen. Infrastructure development authorities in Kenya utilized dual-line configurations during standard gauge railway construction, achieving daily production of 8,500 roof panels. Major cold storage facility operators throughout Eastern Europe increased insulation panel output 230% using parallel processing systems. Shipbuilding enterprises in South Korea integrated Chinese-made roll formers into hull component production, reducing material waste by 29% through precision profile cutting.

Double Layer Roll Forming Machine China Pricing Strategy and Procurement Insights

Export pricing structures demonstrate transparent engineering value relationships independent of arbitrary regional markups. Entry-level dual-operational systems start at $98,500 for base configurations handling standard roofing profiles. Production-scale installations with automated stacking average $285,000 for configurations including PLC-based thickness monitoring and real-time quality control instrumentation. Customs clearance facilitation has expanded dramatically; bonded zone warehouses maintain $60 million in rotating inventory across fifteen strategic ports. Procurement specialists recommend comprehensive technical audits with production simulations to determine exact specifications before purchase orders. Global shipment data confirms consistent 22-day maritime transit from Chinese manufacturing hubs to Eastern Seaboard ports.

(china double layer roll forming machine)